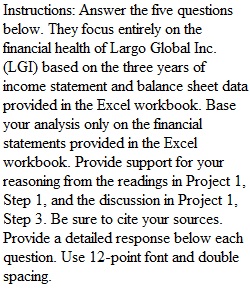

Q Project 1: Analyzing Financial Statements Step 5: Prepare the Analysis Report for Project 1 Today you will meet with your team to discuss the reasons for LGI's reduced operational efficiency. The reduced efficiency has raised questions about the company's income statement, balance sheet, and statement of cash flows. Answer the questions in the Project 1 Questions – Report Template document. Prepare your analysis report including recommendations for how the company can improve its financial situation. To complete the analysis report for the project: • Download the Project 1 Questions – Report Template • Read the instructions. • Answer all the questions. • Include your recommendations. • Submit the business report (Word document) and calculation (Excel file) to the Assignments folder as your final deliverable at the end of Week 2. Label your files as follows: o P1_Final_lastname_Report_date.docx o P1_Final_lastname_Calculation_date.xlsx Check Your Evaluation Criteria Before you submit your assignment, review the competencies below, which your instructor will use to evaluate your work. A good practice would be to use each competency as a self-check to confirm you have incorporated all of them. To view the complete grading rubric, click My Tools, select Assignments from the drop-down menu, and then click the project title. • 3.2: Employ mathematical or statistical operations and data analysis techniques to arrive at a correct or optimal solution. • 3.4: Employ software applications and analytic tools to analyze, visualize, and present data to inform decision-making. • 6.2: Evaluate strategic implications for domestic and international markets of an organization's industry. • 10.2: Analyze financial statements to evaluate and optimize organizational performance. Take Action Submit your assignment to your instructor for review and feedback. Follow these steps to access the assignment: • Click My Tools in the top navigation bar. • Click Assignments. • Select the relevant assignment. Project 1 Report Instructions: Answer the five questions below. They focus entirely on the financial health of Largo Global Inc. (LGI) based on the three years of income statement and balance sheet data provided in the Excel workbook. Base your analysis only on the financial statements provided in the Excel workbook. Provide support for your reasoning from the readings in Project 1, Step 1, and the discussion in Project 1, Step 3. Be sure to cite your sources. Provide a detailed response below each question. Use 12-point font and double spacing. Maintain the existing margins in this document. Your final Word document, including the questions, should not exceed 5 pages. Include a title page in addition to the five pages. Any tables and graphs you choose to include are also excluded from the five-page limit. Name your document as follows: P1_Final_lastname_Report_date. You must address all five questions and make full use of the information on tabs 2–4 as well as the competitor and industry data in the Excel workbook (ratio, common-size, and cash flow analysis). You are strongly encouraged to exceed the requirements by refining your analysis. Consider other tools and techniques that were discussed in the required and recommended reading for Project 1. This means adding an in-depth explanation of what happened in the three years for which data was provided to make precise recommendations to LGI. ? 011022 Title Page Name Course and section number Faculty name Submission date ? 2222 Questions: 1. How would you assess the overall financial health of Largo Global Inc. (LGI)? You will need to provide a broad view of the main trends that emerge from your analyses of the information in tabs 2, 3, and 4. Your key findings should be synthesized and highlight a clear diagnostic of LGI's financial strength and/or weakness. [HINT: all 5 questions are interrelated and may sometimes build on each other – it is imperative that you develop a “blue-print” or an outline of what you are answering for each question. Do not answer each question independently as if they were not connected. You should not be redundant but should make sure that you are judiciously coordinating these 5 questions. Question 1 and 5 should be providing the introduction and conclusion of your analysis. Questions 2, 3, and 4 should be providing the “body” or development of your analysis – with a focus on operations, investing, and financing] [insert your answer here] 2. How is LGI doing in terms of operating efficiency? How would you assess its performance compared to its main competitor and the industry index? What are the principal areas that need to be addressed to strengthen LGI' s bottom line? Identify and use key indicators from all 3 analyses that provide insight about LGI's operations. [HINT: Focus of this question is the Income Statement and the Net Working Capital (NWC) as it relates to Current Assets and Current Liabilities] [insert your answer here] 3. How is LGI doing in terms of using assets efficiently? How would you assess it compared to its main competitor and the industry index? What are the principal areas that need to be addressed to strengthen the left-hand side of its balance sheet? Identify and use key indicators from all 3 analyses that provide insight about LGI's assets. [HINT: Focus of this question is the firm’s assets excluding current asset] [insert your answer here] 4. How is LGI doing in terms of financial leverage? How would you assess it compared to its main competitor and the industry index? What are the principal areas that need to be addressed to strengthen the right-hand side of its balance sheet? Identify and use key indicators from all 3 analyses that provide insight about LGI's debt and equity mix. [HINT: Focus of this question is the firm’s liabilities and equity excluding current liabilities] [insert your answer here] 5. Based on the financial strengths and weaknesses of LGI, how would you prioritize actions that will ultimately satisfy LGI' s shareholders? Make specific recommendations that clearly identify the decisions LGI' s board and executives need to make. What actions do they need to take? Set quantifiable targets and objectives for LGI. Your answers must be supported by all arguments developed in questions 2, 3, and 4. In addition, make sure you use data not already used in previous questions. [HINT: Be strategic as you will revisit this question when you reach the last project of this course.] [insert your answer here]

View Related Questions